The WSJ and their “Your Money Briefing” podcast had an incomplete discussion on retirement plans. Since they specifically targeted physicians, and we had a physician client reach out asking about getting a cash balance plan, we felt it imperative to offer additional discussion to Ariana Aspuru and Anne Tergesen’s Money Briefing discussion.

They spent significant time discussing how a cash balance plan enables you to contribute more pre-tax dollars to retirement. They highlighted how additional pre-tax contributions can help you catch up on retirement.

The discussion can be summed up with the thought, “Well Mrs. Lincoln, other than that how was the play?” as they completely disregarded the elephant in the room… cash balance plans only enable you to invest in cash equivalent investments. The impact of the limited investment is so severe that we have only seen doctors regret investing in Cash Balance plans and unwinding cash balance plans.

Why Do Physicians Regret Investing in Cash Balance Plans?

Over the past 15 years, those cash equivalents averaged a per year return of 3.3% while the S&P 500 over the same 15-year period averaged a 13.8% return. That is a significant difference and creates huge differences in your final retirement number.

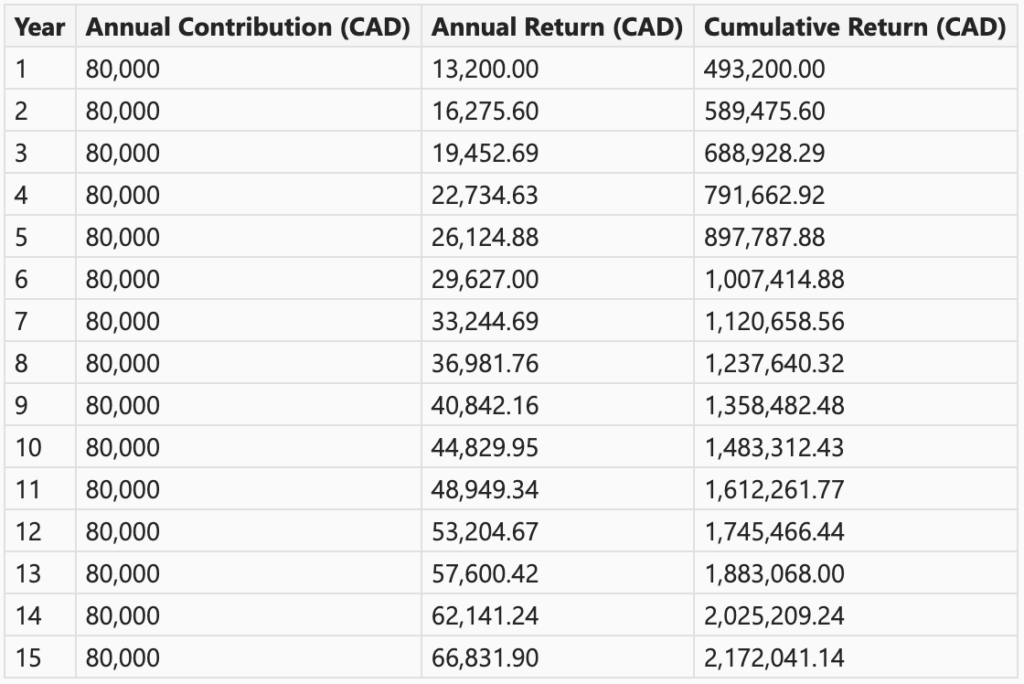

Consider the following basic scenario; you have $400,000 in retirement now and you want to retire in 15 years, so you make retirement funding your primary goal. With that in mind, you start setting aside $80,000 of your income per year for retirement.

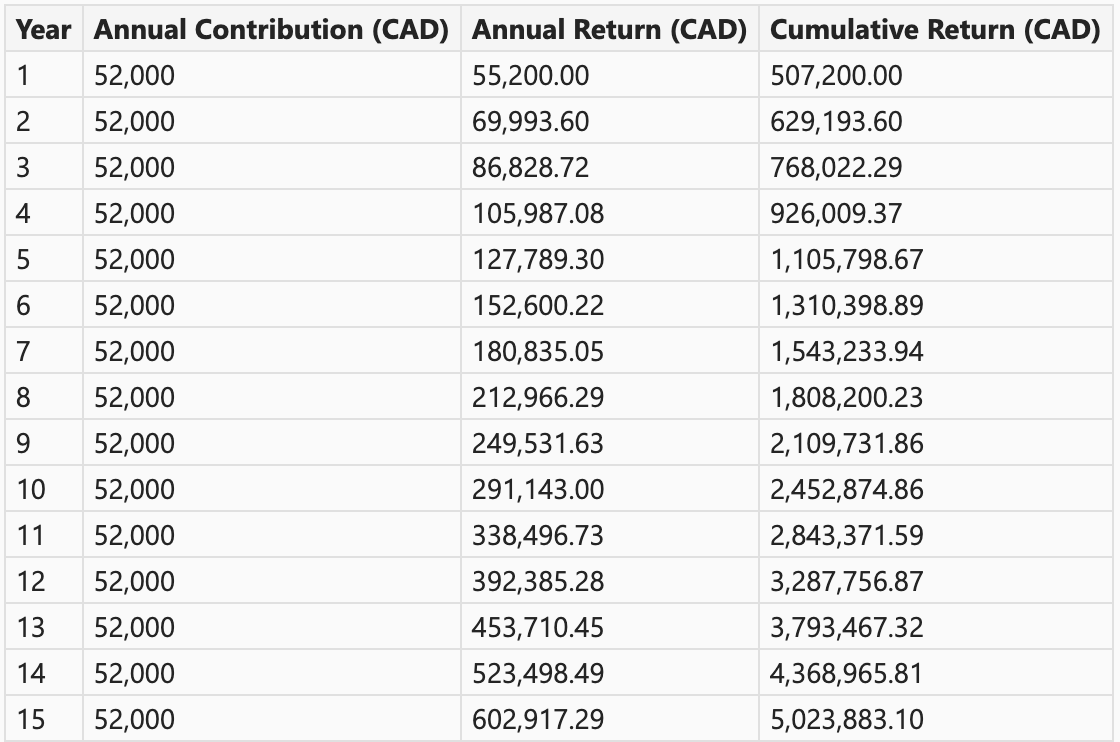

We are going to compare two options: 1st is a cash balance and 2nd is a regular after-tax brokerage account. For simplicity’s sake, so we can focus on the big picture investment returns, we are going to assume 35% ordinary income tax rates and 24% capital gains rate as well as assuming the fees for cash balance and traditional brokerage are the same with the knowledge you could pay for a very high-end broker and still have lower costs than cash balance compliance costs.

Option 1: Cash Balance Plan and Your 3.3% Returns

Now when you want to get money out of a cash balance plan it is all taxed at ordinary income tax rates. Hypothetically, let us assume you pulled it all out in year 16, the tax would be $760,000 so you are left with $1,412,000 after tax.

Option 2: Traditional Brokerage Account

Here you have a traditional brokerage account so if you are setting aside $80,000 that will enable you to invest $52,000 a year because you are paying ordinary income on the front end and capital gains on the earnings in the back end. Look at the 13.8% impact. Now let us assume the same hypothetical that you pull out all the investment in year 16. Since you paid tax along the way, when you want to sell your S&P investment you only pay capital gains on the earnings. Here you contributed $780,000 and had a value of $5,020,000 so your earnings were $4,240,000 so you have tax of $1,020,000 and therefore are left with $4,000,000 in year 16.

What Do the Results Look Like?

The difference in after-tax retirement funds in year 16 is $4,000,000 compared to $1,400,000 on the exact same amount being set aside but one limiting the investment option to cash equivalents. Be diligent with retirement savings but do not leave $2,600,000 on the table.

One key point not covered is the mandatory employee costs of cash balance plans. This was omitted because most physicians are generous and would pay their employees the same amount whether in a cash balance plan or in wages.